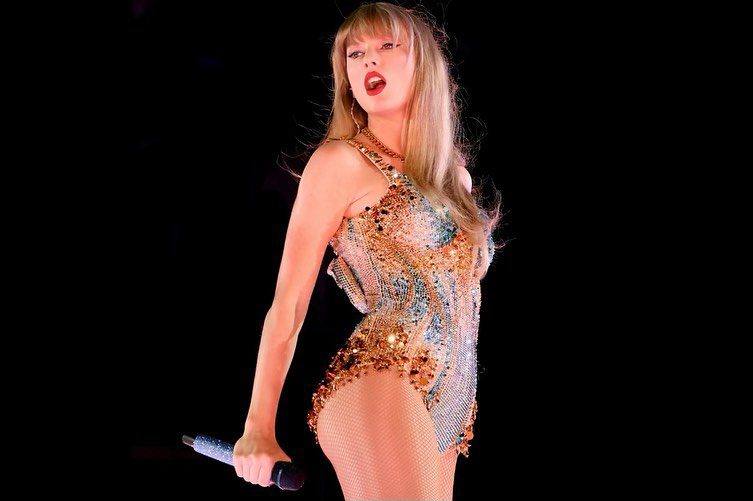

In the presence of PM Modi and UAE President Sheikh Mohamed Bin Zayed Al Nahyan, agreements were exchanged.

Amidst the golden sands of Abu Dhabi, an enchanting tale of collaboration and innovation unfolded as the Reserve Bank of India (RBI) and the Central Bank of UAE (CBUAE) etched history with their mesmerizing agreements. Like two maestros harmonizing their symphonies, they inked not one but two extraordinary pacts, captivating the world with the promise of a mesmerizing cross-border transformation.

Beneath the watchful gaze of the sun-kissed heavens, the grand stage was set, where the visionary leaders of two nations, Prime Minister Narendra Modi and President Sheikh Mohamed Bin Zayed Al Nahyan, stood as beacons of hope. With a flourish of signatures, the first agreement took flight – a resplendent framework for cross-border transactions in the realm of local currencies.

The Indian Rupee (INR) and the UAE Dirham (AED), once mere pieces of paper, now stood endowed with a newfound significance. Their passage across borders was no longer limited by the whims of a distant US dollar. In a triumphant dance, they would now intertwine, empowering businesses and dreamers alike to transcend financial barriers with ease.

The foundation of this financial wonderland lay in the creation of a majestic Local Currency Settlement System (LCSS). Like a majestic bazaar of currencies, it invited merchants from both lands to trade in their own coinage, fostering camaraderie and prosperity. As exporters and importers joined hands in this mesmerizing dance, a harmonious melody of bilateral investment and remittances began to resonate between the two nations.

As dusk gave way to twilight, the second agreement emerged, a symphonic collaboration in linking their Fast Payment Systems (FPSs). India’s Unified Payments Interface (UPI) and UAE’s Instant Payment Platform (IPP) were the celestial dancers, twirling gracefully to connect distant souls. No longer would borders confine the flow of funds; a bridge of secure and cost-effective cross-border fund transfers was now erected, uniting hearts separated by oceans.

Yet, the crescendo did not end there. In an awe-inspiring encore, the two central banks explored the art of joining their Card Switches – the ethereal RuPay switch for India and the celestial UAESWITCH for UAE. This divine alliance bestowed upon their people the ability to dance with their domestic cards, whisking away financial barriers with every transaction.

In this artistic tableau, the central banks embarked on a daring exploration of their messaging systems – India’s Structured Financial Messaging System (SFMS) and the UAE’s ethereal messaging system. As these systems fused into one, they birthed a symphony of seamless financial messaging, a mesmerizing harmony that united financial destinies.

In this mesmerizing duet between India and UAE, the world witnessed a spellbinding transformation. Like master artisans, they crafted a magnum opus of financial integration, drawing applause from every corner of the globe. With the stroke of a pen, the RBI and CBUAE had composed an enduring ode to mutual prosperity and camaraderie, forever changing the melody of cross-border transactions.

As the sun dipped below the horizon, casting its final rays of light, the world marveled at this majestic partnership. A captivating symphony had been born – an opus of financial brilliance and cooperation. And in its wake, a new era of economic magic had dawned, leaving a lasting impression on the hearts of nations and people alike.